Monetizing the Colossal Costs of COVID-19

Mountains of money cause inflation

Inflation causes increases in interest rates, lowering bond prices

Increases in interest rates cause reductions in stock values

Please watch our video on the impact of COVID relief on the economy and securities markets.

President Biden’s $1.9 trillion American Rescue Plan is the third dose of economic COVID relief bringing the total to $5.2 trillion, which is about 25% of GDP (Gross Domestic Product). It’s huge. $5.2 trillion is the total cost of all our wars since 2001, and is greater than even our most expensive war in history, World War II.

Many believe that all this relief is simply spending our previous tax payments, but the truth is that our government is creating new money, spending future tax payments, and distributing it widely as summarized in the next graph.

Approximately $1 trillion out of $5.2 trillion has been paid directly to taxpayers in the form of personal relief checks. The remaining $4.2 trillion has paid for vaccines, unemployment, and other purposes. Controversially, this newest package is loaded with what is called “Pork” – unrelated applications -- as shown in the following.

The general sentiment so far is that this relief is welcome and good, but there is legitimate concern about its impact on the US dollar, namely inflation. For example, there is a lot of concern about the recent increase in the yield on 10-year government bonds, from 0.5% to 1.7%. Rising interest rates mean lower bond prices and can lead to lower stock prices, as I discuss in this article.

Inflation on the Horizon

The US has jumped in with both feet in providing COVID relief. We are spending more than any other country, including Japan, the acknowledged pioneer of liberal money printing. We’ve spent 25% of GDP so far.

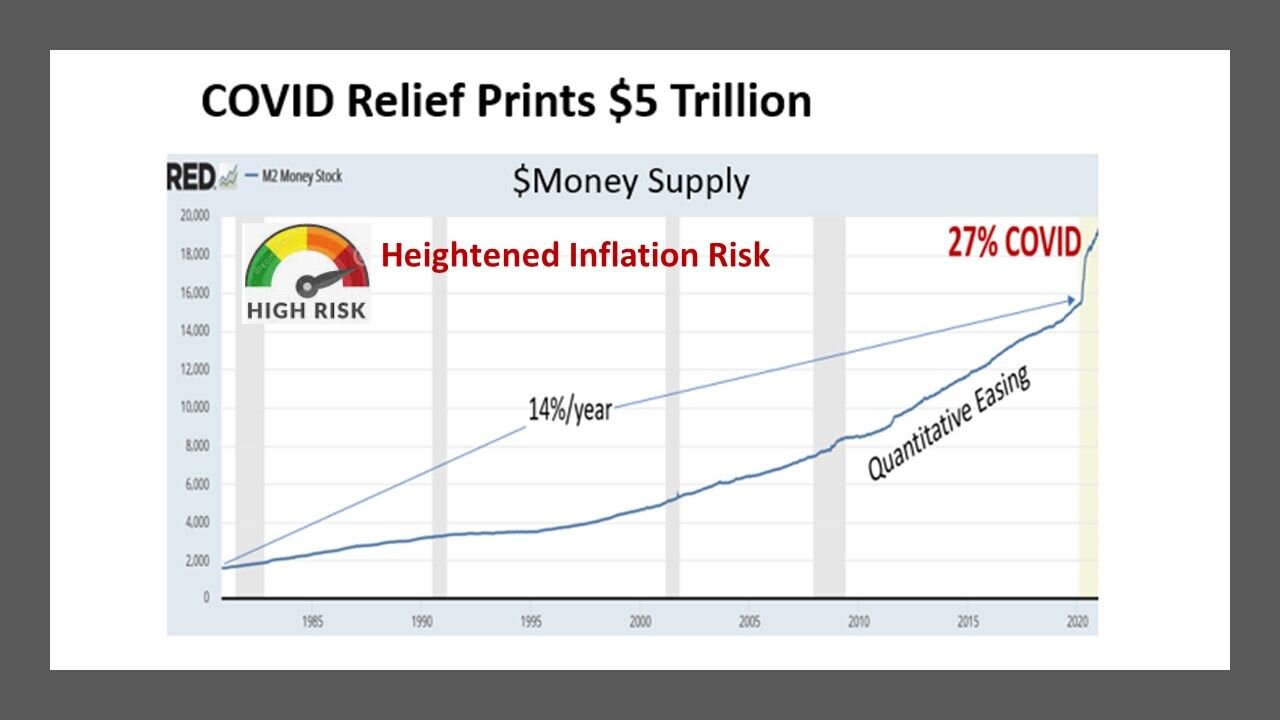

Demand-pull inflation occurs when too many dollars are chasing too few goods, which is a real possibility. The money supply normally grows about 7% per year but quantitative easing (QE) of more than $4 trillion has increased money supply by 14% per year over the past decade. The $5 trillion in COVID relief increases the money supply by 27% and does so very quickly – the floodgates are open.

The government doesn’t actually run the printing presses to create all this new money. The Treasury issues bonds. Note that your relief check says “US Treasury.” Under normal circumstances there are plenty of buyers for these bonds, including foreign governments like China and Japan, but these are not normal circumstances, so the Federal Reserve is buying most of the Treasury’s new bonds.

Modern Monetary Theory (MMT) argues that the government can solve economic problems by printing money until it causes inflation, at which time taxes need to increase to rein in that money. Quantitative Easing did not bring inflation as measured by the Consumer Price Index (CPI), so that experiment has been declared a success, but the reality is that QE did inflate stock and bond prices, so there was inflation but not in the usual metric. By contrast, much of the COVID relief money will go directly into the hands of the consumer, so CPI will increase. This time we’ll actually see inflation.

QE dug the US economy into a monetary hole but avoided setting off inflation alarms. COVID relief turns the corner and heads us squarely into CPI-measured inflation.

Many see deflation ahead rather than inflation. There are plenty of deflationary forces in place, as shown in the following picture, but these will eventually become dwarfed by the mounds of money pouring into the economy. It could take a while, but inflation will eventually dominate.

According to a recent Bank of America survey of investment professionals, “A net 93% of fund managers expect higher inflation in the next 12 months, up 7% from the prior month’s survey and an all-time high.”

Increasing Interest Rates

Ibbotson Associates popularized a formula for bond yields, namely inflation plus a risk premium. Real (above inflation) bond yields should be positive, or something is wrong. Something has been wrong with the government’s Zero Interest Policy, or ZIRP. The Fed has manipulated interest rates to keep them low in order to keep interest on government debt low, but this manipulation cannot move beyond short maturities to longer maturities. The market will price long term bonds and it will price them to earn a premium above inflation. Interest rates will rise, and this will topple the entire “House of MMT-ZIRP Cards”

Protection from Inflation and Bursting Bubbles

There’s little debate about the current existence of a bond bubble because it’s well known that yields are being suppressed by the Fed. But there is debate about the existence of a stock market bubble, primarily because stock prices continue to go up, driven by 15 powerful forces. There are several measures of stock market expensiveness, including the popular “Buffett Bubble Barometer” that is currently at its all-time high.

This “bubble” defies bursting and has in fact grown 75% since it’s low in March of last year. But one of the most frequently stated justifications for this increase is about to change. Wall Street justifies high stock prices by explaining that low interest rates translate into high present values of future earnings. Consequently, increasing interest rates are expected to reduce discounted earnings and therefore “fair value.” Stock prices will fall. Whether this will happen as a burst or a gradual deflating remains to be seen.

In normal situations, investors can protect themselves from bursting stock and bond bubbles by moving to the safety of cash, but inflation fears argue against this move. “Safe” in these conditions is hedged against inflation, like the following investments.

Inflation protections

Precious metals, especially Gold

Cryptocurrencies like Bitcoin (S2, E7)

TIPS: Treasury Inflation-Protected Securities

Inflation hedged stocks like materials & staples

Commodities, including energy & food

Some real estate, like farmland

Some foreign stocks

Is it Possible That We’ve Been Conned?

I recently got hooked on the TV series The Hustle and I’m binge watching its 8 seasons. Each episode follows a pattern – the rules of the professional con. It strikes me that we may have been conned into printing a mountain of money as follows.

The “Mark” in this con is the United States, specifically members of Congress. The “Grifter” is China that is caught in the Thucydides’ Trap, and seeks to be number one. And the “Shills” are U.S citizens, who mostly support big spending.

The stages of the con progress as follows:

Foundation ( identify vulnerabilities): Congressional members are greedy and mostly focused on getting re-elected. Voters want free stuff like healthcare and education and relief checks.

Approach: Create a “theory” that liberates spending from a budget. Money printing is justified by “Modern Monetary Theory” (MMT) – print all you want. Free stuff makes voters happy.

Build-up: Following Japan’s lead, the US launches Quantitative Easing (QE) in 2008 to head off a recession, printing more than $4 trillion.

Pay-off or convincer: QE works!! The recession ends quickly, the stock market enjoys its longest recovery and inflation is subdued.

The "hurrah": A sudden manufactured crisis or change of events forces the victim to act or decide immediately. The COVID pandemic breaks out, originating in China.

The sting: Congress approves another $5 trillion in COVID relief plus President Biden plans to spend at least another $2 trillion on infrastructure and other projects. So, $11 trillion in new money (counting QE), which may be enough to bring hyperinflation.

Conclusion

Unconventional times require unconventional thinking.

Monetizing $5.2 trillion in COVID relief increases our money supply by 27% and comes on top of $4.5 trillion in QE. Add another $2 trillion in planned infrastructure spending and we have $12 trillion in new money, which is a 35% increase in paper money in circulation and 60% of GDP. It’s a lot of paper. The total cost of our 13 most expensive wars is $10 trillion.

Paper money is called “fiat currency” because it only works if we all agree it works – by fiat. Recent interest in alternative money like gold and cryptocurrencies is evidence that some are losing confidence in fiat money. Inflation is becoming a big concern.

Inflation will trigger bursting of stock and bond market bubbles, but a run to safety needs to consider the eroding effects of inflation Safety needs to be sought in inflation protected investments.

$5.2 trillion in COVID relief will tip us over the monetary edge. We’ve been ”poking the bear” testing to see how much money can be printed without repercussions. My personal feeling is that the bear is awake now and about to attack. Baby boomers need to be especially concerned because their lives might never be the same if they don’t protect now. Younger investors have a shot at recovery.