Prudent Personalization of Retirement Investments in Group Plans and IRAs

Stop Exposing Your Participants to Excessive Risk. Modernize Your QDIA Now.

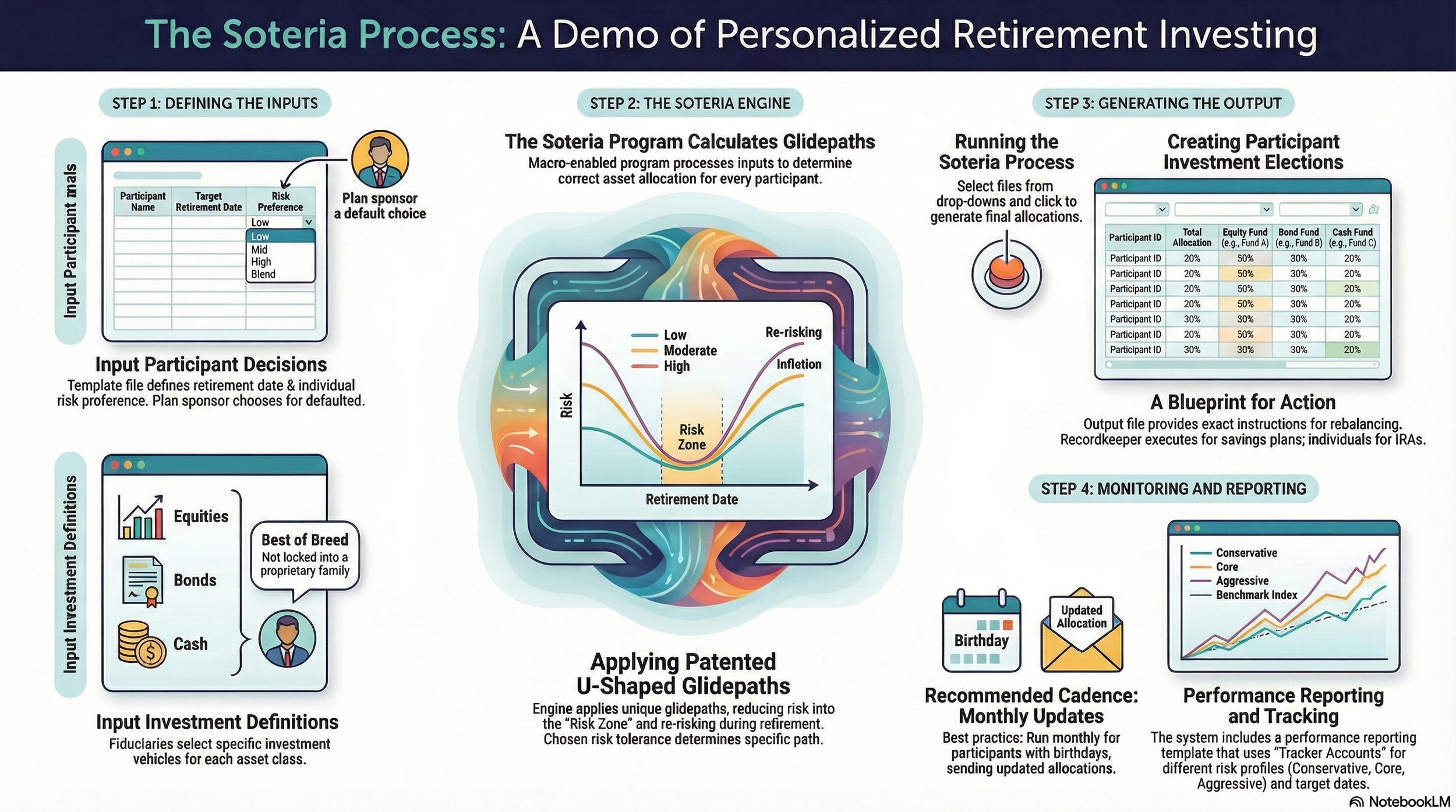

Soteria is a next-generation Software-as-a-Service platform designed to replace traditional Target Date Funds and high-fee Managed Accounts with Personalized Target Date Accounts (PTDAs) built for true prudence.

Big Ideas, Real Impact Watch Our Demo

Thoughtfully crafted to elevate what matters most.

Driven by curiosity and built on purpose, this is where bold thinking meets thoughtful execution. Let’s create something meaningful together.

Stop Exposing Your Participants to Excessive Risk: Modernize Your QDIA Now.

The Risk Hidden in Today’s Defaults

Soteria (Software-as-a-Service): Deliverance from Harm. Traditional Target Date Funds(TDFs) operate on a "one-size-fits-all" mentality, leaving millions of participants vulnerable to market crashes. This outdated approach exposes fiduciaries and plan sponsors to significant legal and financial risk.

Soteria is the new disruptive innovation intended to replace both TDFs and high-fee Managed Accounts (MAs). We provide a modernized framework for Personalized Target Date Accounts (PTDAs) that achieves substantive prudence—doing what is best and right for the investor.

Modernize Your Retirement Strategy with Soteria Software

Soteria—named for the goddess of deliverance from harm—is a proprietary SaaS platform engineered by Ron Surz to correct the critical flaws in conventional 401(k) default investing.

Soteria enables Personalized Target Date Accounts (PTDAs) that combine patented safety with individualized risk alignment—doing what is best and right for the investor.

Meet the Founder

Ron Surz is the president of Target Date Solutions and a leading innovator in retirement investing. He is the developer of the patented Safe Landing Glide Path®, Soteria personalized target date accounts, and Age Sage, a do-it-yourself investing platform. Ron is also recognized as the co-host of the Baby Boomer Investing Show, where he shares his expertise and passion for helping his fellow baby boomers navigate the complexities of retirement planning.

With a deep commitment to ensuring retirees can enjoy their golden years with financial security and dignity, Ron authored the influential book Baby Boomer Investing in the Perilous 2020s. He further extends his impact by co-hosting a financial education curriculum and publishing a widely read newsletter dedicated to baby boomers.

Ron’s latest work, Fixing Target Date Funds, was published this year, promising fresh insights and solutions for the evolving retirement landscape. Through his leadership, educational efforts, and innovative products, Ron Surz continues to be a trusted advocate and resource for those preparing for and living in retirement.

How Soteria Is Different?

Mitigate Sequence of Return Risk (SoRR):

Unlike other Qualified Default Investment Alternatives (QDIAs), Soteria’s methodology is structured to explicitly manage Sequence of Return Risk (SoRR). Soteria uses a U - shaped glidepath that protects participants in the Risk Zone (the 5 years before and after retirement) by mandating a severe reduction of risk — a "safe landing" — before responsibly reintroducing growth assets later in retirement.True Personalization

The software moves beyond just Risk Capacity (a function of age and wealth) to prioritize alignment with a participant’s Risk Tolerance (emotional comfort and willingness to take risk).Best-of-Breed Investment Flexibility Soteria provides the asset allocation engine without mandating proprietary funds. Fiduciaries and consultants can plug in their preferred investment lineup and retain full control.Best - of - Breed Investments

Soteria provides the asset allocation blueprint but does not mandate a specific fund series, enabling fiduciaries and consultants to "plug their investment choices" into the engine and utilize "best of breed investments" rather than being limited to proprietary fundsExceptional Value

Soteria offers sophisticated personalization and patented safety at a competitive, low cost, typically priced below 20 basis points (bps) , which is significantly less than half the average cost of traditional Managed Accounts.

Safety in the

Risk Zone

The single greatest threat to retirement success is Sequence of Return Risk (SoRR) — a devastating market loss sustained during the "Risk Zone" (the 10 years spanning retirement). Soteria is engineered precisely to manage this failure point.

-

Unlike conventional glide paths that remain risky near retirement, the SLGP mandates a U - shaped trajectory that reduces equity exposure dramatically leading into the target retirement date (the safe landing) and then re - risks later in retirement to combat longevity risk.

-

This structure aligns with academic research by Dr. Wade Pfau and Michael Kitces, who advocate for entering retirement with low risk and subsequently increasing equity exposure.

-

The SLGP has a proven 16-year track record. Historically, the typical TDF lost 30% in 2008, while the Safe Landing approach protected participants with a single-digit loss

Ready to move beyond conventional risk?

Choose your role:

Recordkeepers

(SaaS Platform)

Key Benefits

Disruptive Economics: Soteria is delivered as a Software-as-a-Service (SaaS) platform for maximum scalability. The all-in cost is aggressively positioned below 20 basis points (bps), far undercutting the high fees of Managed Accounts (>50 bps).

Competitive Edge:

Offering PTDAs is a robust source of marke t differentiation and a competitive advantage over competitors who only offer “one-size-fits-all” TDFs.

Turnkey Implementation:

Seamless integration is possible through alliances, such as the partnership with AccuRecord.

Financial Advisors & Consultants

(Fiduciary Solutions)

Key Benefits

Fiduciary Defense: Provide a demonstrably Superior Qualified Default Investment Alternative (QDIA) that proactively manages SoRR. This is essential for mitigating administrative fiduci ary risk, especially given the rising scrutiny on recordkeeper prudence in lawsuits (e.g., cybertheft cases).

Flexibility: Unlike proprietary TDFs, Soteria allows you to “plug your investment choices” into the engine, ensuring the use of “best of breed inv estments” selected purely on merit and cost.

True Personalization: Move your clients past “Risk Capacity” (age/wealth) to align with their actual Risk Tolerance (emotional comfort), improving adherence during downturns.

Savers & Participants

(Individuals)

Key Benefits

Safety Transition: Ensure your savings are protected exactly when you need it — near retirement. The SLGP is explicitly designed to protect participants against sudden losses dur ing the volatile Risk Zone.

Self-Directed Engagement: If you are a self-directed participant, you gain the flexibility to manage your own unique glide path by selecting and blending Low, Moderate, or High risk preferences, correcting the “one-size-fits-all” flaw.

Request Your Personal Consultation

Take the first step toward implementing a demonstrably superior QDIA for your clients or plan participants. Enter your information below to learn how Soteria can help you achieve substantive prudence — doing what is best and right for the investor.

A personalized call will be scheduled with Ron Surz, President of Target Date Solutions and creator of Soteria SaaS, to go over the specific details and instructions for installing and using the software.